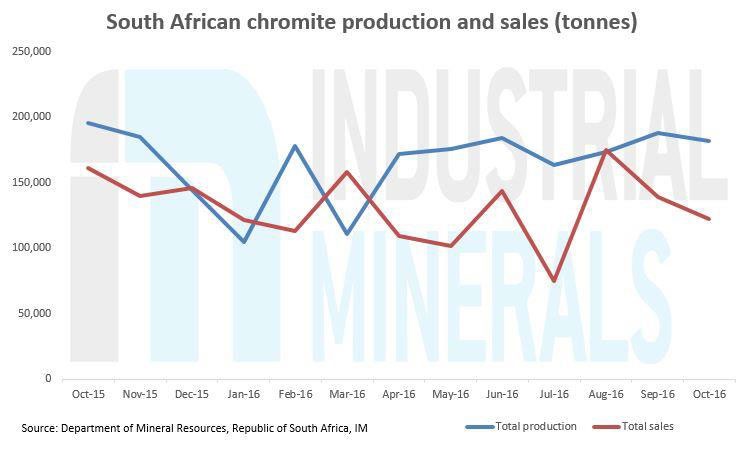

Monthly production of chromite with 44-48% Cr2O3 content was down both on a sequential and year-on-year basis, as reduced mining capacity is denting overall sales volumes.

South African output of high-purity chromite fell in October after a surge in the previous month, while the latest output remained some 15,000 tonnes below the same time in 2015, government data provided to IM shows.

Total production of chromite with 44-48% Cr2O3 content stood at 181,847 tonnes in October, marking a 7% decrease year-on-year (y-o-y). This follows capacity shutdowns that took place in the country during the 2015/16 phase of weak markets.

The October output fell also on a sequential basis after production peaked in September to close to 188,000 tonnes, a record-high for 2016 to date.

Total sales, including domestic and exports, stood at 122,418 tonnes for the month. This was 12% down on September and almost one-quarter (24%) below October 2015 sales.

Sources active in the chrome industry in South Africa told IM this week that «supply will remain below 2015 levels for the foreseeable future», citing the closure of a number of mines and processing operations, such as Dilokong Chrome and MTI.

«Availability is particularly tight for the underground-mined ores, as underground mines were the first to close when prices were low due to high operational costs,» one local producer told IM.

Shipping operations at the country’s main ports – Richards’ Bay and Durban – were affected by low availability of vessels in the late months of 2016, prompting delays as sellers were unable to secure cargo space on ships.

Exports accounted for over 60% of total volume sales in October.

Domestic sales generated a turnover of South African rand (Zar) 83.6m ($6.3m), while exports were worth Zar 191.1m. At the same time, both the local and export markets have remained a notch below the levels of trade seen in late 2015, further showing that the overall mining capacity in South Africa has shrunk in size.

Prices

The export market for chromite meanwhile remained quiet and stable over the past fortnight against the levels it reached at the end of December.

Suppliers ascribed the lack of business to the impending Chinese New Year holiday period, which starts 27 January.

In the words of a European supplier, «China was instrumental in driving prices upwards last year, both for met and non met chrome».

«We’ll have to see what strategies they put forward after the holidays,» he added.

IM is currently tracking prices of chemical chromite, 46% Cr2O3, wet bulk at a range of $430-440/tonne FOB South Africa, unchanged compared with previous weeks.

Foundry grade chromite, 46% Cr2O3, wet bulk, is meanwhile priced at a range of $410-450/tonne FOB South Africa.

The surge in export prices in the second half of last year prompted miner Afarak Trading to look to reopen its opencast mine in Mecklenburg, the company confirmed to IM this month.

The company is also looking to develop an underground operation at the site, with a view to fill part of the gap in supply of underground-extracted LG chrome ore. Works are expected to start soon.

South Africa is world’s largest supplier of chrome ore, which is used in a number of metallurgical and non metallurgical applications alike. While low-grade UG2 chrome ore (usually with a 40-42% Cr2O3content) is one of the main met grades, non met industries including chemicals, foundry and refractories employ higher-purity chromite, with a chrome content above 44%.

Some LG chrome of 44% Cr2O3 and above is also used in met applications.

Besides South Africa, other producers of the mineral include India, Kazakhstan, Turkey and Pakistan.