Alkali resistance of refractories plays a role wherever alkali loaded gases or dusts have the chance to be deposited in the structure and to react with the refractory material, e.g. dust chambers or combustion chambers.

Nov 12

Alkali resistance of refractories plays a role wherever alkali loaded gases or dusts have the chance to be deposited in the structure and to react with the refractory material, e.g. dust chambers or combustion chambers.

Nov 05

En esta ocasión nos centramos, entre otros, en la traducción del libro “Refractory Engineering”, tema del que llevamos unas cuantas reuniones hablando y que parece que finalmente se va a va a llevar a cabo, debido a la importante que creemos que tiene disponer del libro en Castellano.

Otro de los temas que se confirmó fue la II Edición del Curso de Ingeniería de Refractarios, curso que tendrá lugar en Sevilla del 11 al 14 de marzo, esperamos que esta edición tenga la misma acogida que la anterior.

Se trataron temas contables, haciendo un repaso al año y comprobando como nos encontramos con respecto al presupuesto que se realizó para el 2018 y analizando las desviaciones producidas, aunque hasta el momento no son muchas. Como viene siendo habitual se trató el tema de las cuotas y la necesidad de reajustar las mismas.

Dentro del marco internacional estuvimos hablando sobre la comisiones técnicas y de medio ambiente de la PRE que se han llegado a cabo y el impacto de lo allí tratado para nuestro país.

El Presidente quiso dar la bienvenida a Anfre a Manuel García de Navarro Sic, persona que sustituye a Juan Valledor como representante de la empresa en ANFRE.

Al finalizar la reunión pudimos relajarnos y charlar en la comida ofrecida por ANFRE

Una vez más queremos dar las gracias a todos los asociados por seguir creyendo en ANFRE.

Os esperamos en Febrero.

Oct 29

Imports for the mineral increased in both China and Guyana due to demand from steelmaking end-markets improving, boosting demand for refractory products.

Imports of refractory-grade calcined bauxite in the US increased almost 50% last year against 2016 volumes due to the improvement in the refractories sector following growth in steel output, according to customs data released by the United States Geological Survey (USGS).

US imports of refractory-grade calcined bauxite in 2017 reached 127,000 tonnes, or 47% above the previous year when the country took 86,500 tonnes, as per US Census Bureau figures.

China and Guyana were the two countries producing bauxite for export to the US. Some 56% of total US bauxite imports came from China (71,700 tonnes) while the rest (55,300 tonnes) came from Guyana.

Demand for material from both origin countries increased in 2017, with imports from China rising 34% year on year and imports from Guyana almost doubling its shipments, posting a 96% growth on an annual basis.

While small volumes of material originated from India (3,290 tonnes) and Brazil (547 tonnes) in 2016, no shipments were reported from either country last year.

Rising steel output across all producing regions in 2017 was a crucial factor behind boosting demand for products and driving revenues, major refractories producers, such as Vesuvius and RHI Magnesita, said.

Availability of bauxite is currently tight on the international market, following a series of restrictions at mining and processing facilities in China’s Shanxi province.

This led to an increase in prices for Chinese refractory-grade bauxite, which are still holding at strong levels.

Industrial Minerals assessed refractory-grade bauxite 85% at $450-460 per tonne fob Xingang as of March 22 assessment, up 62.5% from $270-290 per tonne assessed on March 23 of last year.

Refractory grade bauxite 86% held firm week on week at $470-480 per tonne, up 63.8% on an annual basis, while 87% refractory-grade bauxite was assessed at $490-500 per tonne up 58.4% from the same time last year.

Higher purity refractory-grade bauxite 88% stood at $500-520 per tonne as of March 22, up 47.8% on an annual basis.

Oct 22

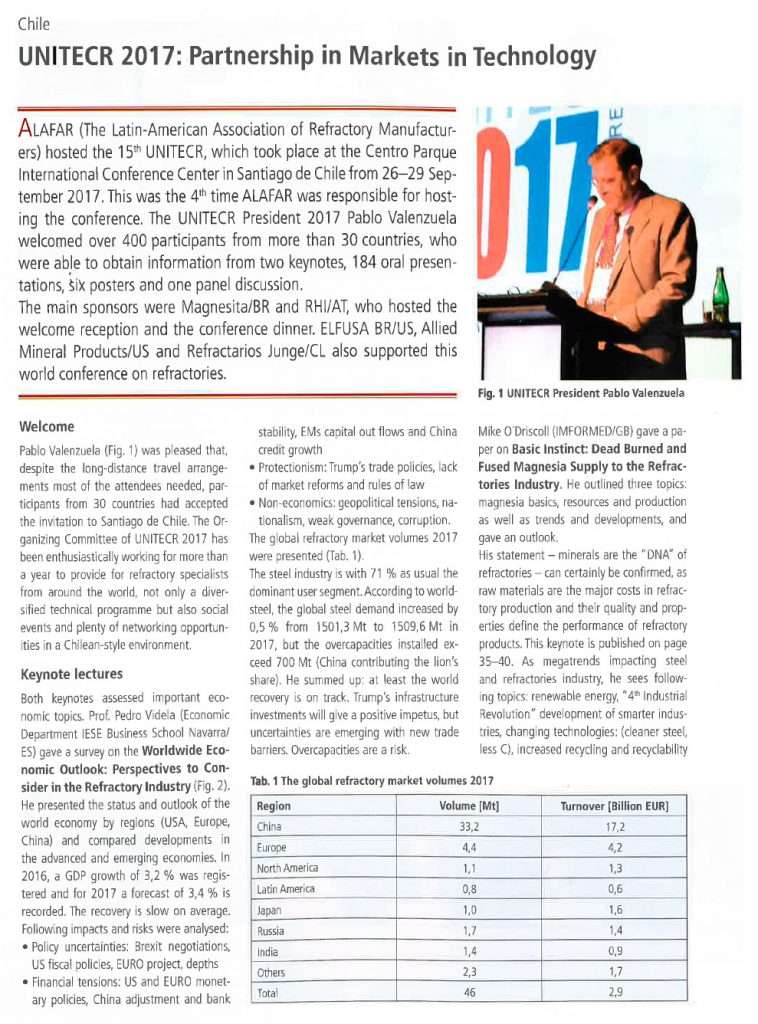

ALAFAR (The Latin-American Association of Refractory Manufacturers) hosted the 15th UNITECR, which took place at the Centro Parque International Conference Center in Santiago de Chile from 26-29 September 2017.

Oct 16

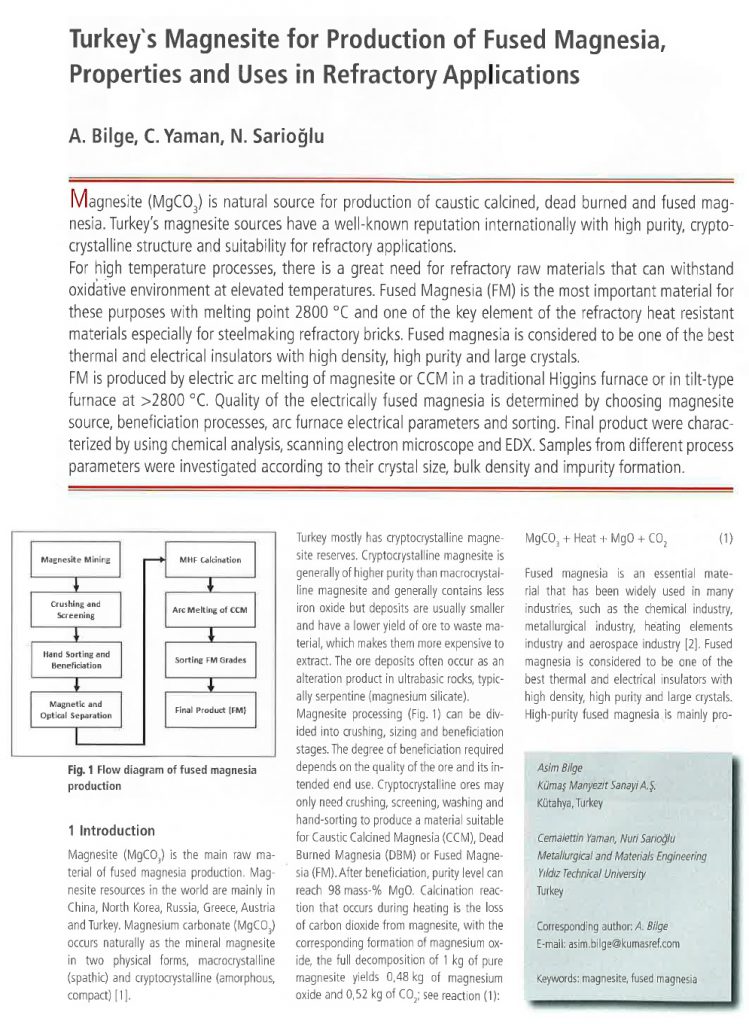

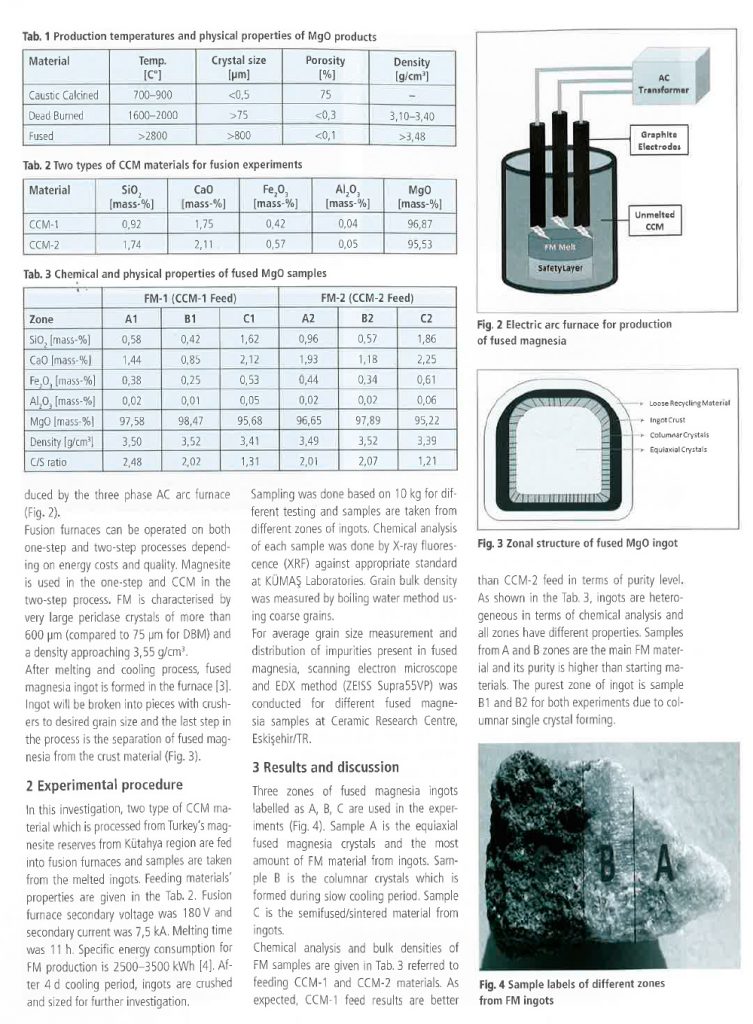

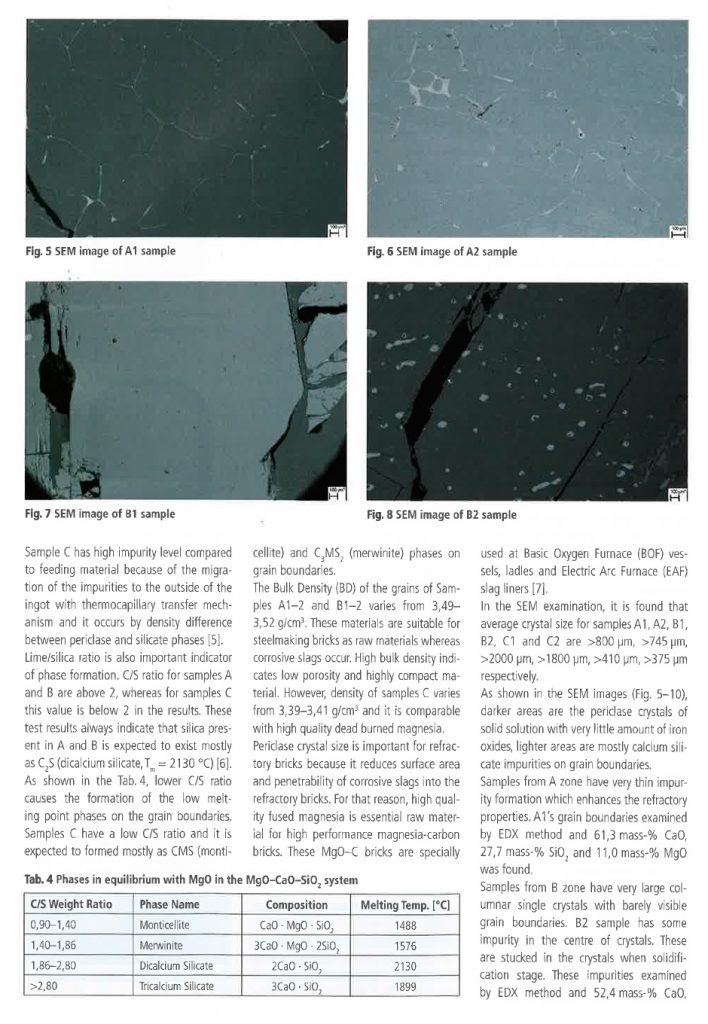

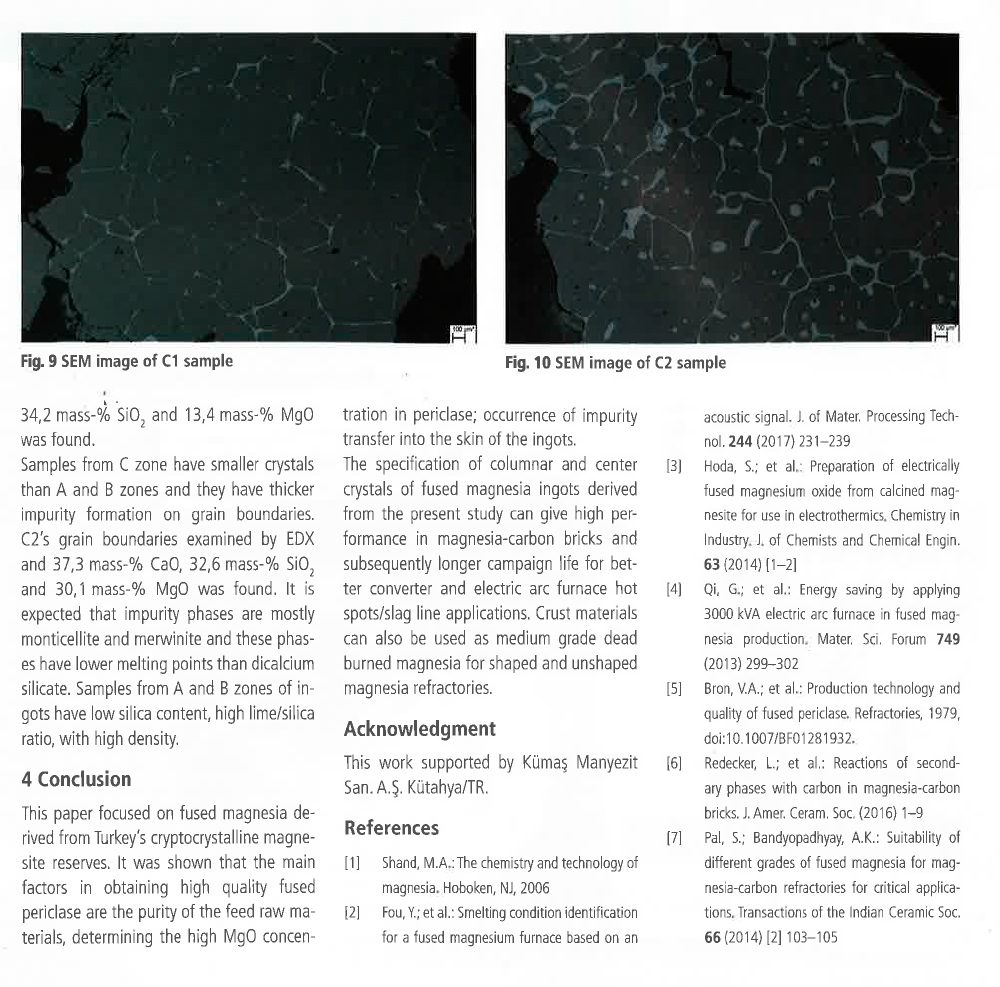

Magnesite (MgCO3) is natural source for production of caustic calcined, dead burned and fused magnesia. Turkey’s magnesite sources have a well-known reputation internationally with high purity, crystocrystalline structure and suitability for refractory applications.