Ante las consultas planteadas por distintas Inspecciones Provinciales, esta Área de Coordinación, de conformidad con lo previsto en el apartado 2º B, de la Resolución del Director del Organismo Estatal Inspección de Trabajo y Seguridad Social de 20-03-2020, sobre organización del Organismo en la gestión de la crisis del COVID-19, que crea la Unidad de gestión de la crisis del COVID, informa lo siguiente:

1) CONSIDERACIONES GENERALES

La presente nota informativa tiene por objeto facilitar pautas orientativas para la unificación de los criterios de los distintos actuantes en la elaboración del informe cuya emisión atribuye la normativa a la Inspección de Trabajo y Seguridad Social.

Como ha sucedido en ocasiones anteriores, su finalidad es procurar que las actuaciones de las distintas unidades territoriales de la ITSS sean homogéneas en todo el territorio nacional. Esa homogeneidad implica que las argumentaciones mantenidas en sus informes han de ser coherentes, sin perjuicio de que la valoración de las circunstancias de cada caso debe corresponder a cada funcionario actuante, que conserva su autonomía técnica y funcional a todos los efectos.

2) MARCO NORMATIVO

Tras la regulación de los ERTE por fuerza mayor que tuviesen su causa directa en pérdidas de actividad como consecuencia del COVID-19, prevista por el artículo 22 del Real Decreto-ley 8/2020, de 17 de marzo, de medidas urgentes extraordinarias para hacer frente al impacto económico y social del COVID-19, el Real Decreto-ley 24/2020, de 26 de junio, de medidas sociales de reactivación del empleo y protección del trabajo autónomo y de competitividad del sector industrial, ha limitado la aplicación del mencionado artículo 22 a los ERTE solicitados antes de la entrada en vigor del mismo, es decir, antes del 27 de junio de 2020 y con una duración, como máximo, hasta 30 de septiembre de 2020.

No obstante, para garantizar la protección de las empresas frente a supuestos en los que se adopten nuevas medidas que afecten al desarrollo de la actividad productiva, el propio Real Decreto-ley 24/2020 prevé en su Disposición adicional primera.2 que las “empresas y entidades que, a partir del 1 de julio de 2020, vean impedido el desarrollo de su actividad por la adopción de nuevas restricciones o medidas de contención que así lo impongan en alguno de sus centros de trabajo, podrán beneficiarse, respecto de las personas trabajadoras adscritas y en alta en los códigos de cuenta de cotización de los centros de trabajo afectados, de los porcentajes de exención previstos a continuación, previa autorización de un expediente de regulación temporal de empleo de fuerza

mayor en base a lo previsto en el artículo 47.3 del Estatuto de los Trabajadores:

a) El 80 % de la aportación empresarial devengada durante el periodo de cierre, y hasta el 30 de septiembre, cuando la empresa hubiera tenido menos de cincuenta personas trabajadoras o asimiladas a las mismas en situación de alta en la Seguridad Social a 29 de febrero de 2020.

b) Si en esa fecha la empresa hubiera tenido cincuenta o más personas trabajadoras o asimiladas a las mismas en situación de alta, la exención alcanzará el 60 % de la aportación empresarial durante el periodo de cierre y hasta el 30 de septiembre.

En este caso, la exoneración se aplicará al abono de la aportación empresarial prevista en el artículo 273.2 del texto refundido de la Ley General de la Seguridad Social, aprobado por el Real Decreto Legislativo 8/2015, de 30 de octubre, así como del relativo a las cuotas por conceptos de recaudación conjunta.”

De esta manera, ante la imposibilidad de tramitar nuevos expedientes al amparo del artículo 22 del Real Decreto-ley 8/2020, pero ante la necesidad de responder a las consecuencias derivadas de nuevas medidas y restricciones, el Real Decreto-ley 24/2020 prevé que aquellas empresas que, a partir del 1 de julio de 2020 vean impedido el desarrollo de su actividad “por la adopción de nuevas restricciones o medidas de contención que así lo impongan en alguno de sus centros de trabajo” puedan disfrutar de diversas exenciones en la aportación empresarial de cuotas de Seguridad Social.

3) PROCEDIMIENTO

La tramitación y autorización de estos expedientes de regulación de empleo de fuerza mayor ha de realizarse con arreglo a lo previsto en el artículo 47.3 del texto refundido de la Ley del Estatuto de los Trabajadores, sin que se haga alusión a ninguna especialidad procedimental, por lo que será de aplicación lo establecido en dicho artículo 47.3 TRLET, así como el 51.7 TRLET, al que se remite el anterior, y en su desarrollo reglamentario, previsto por el Real Decreto 1483/2012, de 29 de octubre, por el que se aprueba el Reglamento de los procedimientos de despido colectivo y de suspensión de contratos y reducción de jornada.

Lo anterior implica que, en estos casos, el informe de la ITSS vuelve a tener carácter preceptivo, y deberá ser emitido a la mayor brevedad posible, al aplicarse el plazo ordinario de resolución del expediente, de cinco días a contar desde la fecha de entrada de la solicitud en el registro del órgano competente para su tramitación.

4) CAUSAS MOTIVADORAS

3.1. Debe partirse de la consideración general de estos expedientes como provenientes de fuerza mayor temporal. Ello quiere decir que resultan aplicables a estos expedientes los elementos comunes que deben concurrir en todo expediente de fuerza mayor temporal:

– Ha de existir un acontecimiento imprevisible, entendido como imposibilidad circunstancial de prevenirlo.

– Ha de ser irresistible o inevitable, empleando la diligencia debida que racionalmente pudiera aplicarse.

– Ha de ser externo a la voluntad del empresario.

– Debe impedir temporalmente el cumplimiento, en todo o en parte, de la obligación y

provenir de una causa extraña a la relación obligacional misma.

– Ha de existir una relación de causa a efecto entre el acontecimiento que revista esas

características y el cumplimiento de la obligación, total o parcial.

3.2. Partiendo de lo anterior, la propia norma prevé los supuestos en los que podrá considerarse que concurre la fuerza mayor en estos ERTE: cuando no sea posible el desarrollo de la actividad por “nuevas restricciones o medidas de contención”.

Debe tenerse en cuenta que la propia norma, sin precisar su concreta naturaleza, hace una distinción entre “restricciones” y “medidas de contención”, lo cual supone una diferenciación entre las mismas. En este sentido, pueden adoptarse decisiones restrictivas que supongan una prohibición expresa, o que limiten actividades con carácter genérico o concreto, confinamiento, etc., o bien pueden adoptarse medidas que, si bien no prohíben una actividad, puedan exigir posteriormente una serie de controles para evitar la propagación de un virus, tales como cuarentenas o realización de pruebas diagnósticas específicas. Por tanto, estas restricciones o medidas de contención tienen

carácter genérico o indeterminado, dada la diversidad de las posibles medidas que se puedan adoptar en el futuro para hacer frente a la pandemia y evitar la propagación de la enfermedad.

Por ello, a la vista de dicho carácter genérico, deberá considerarse en principio causa válida motivadora del expediente de regulación de empleo cualquier tipo de restricción o medida de contención, siempre que afecte directamente a la actividad de un centro de trabajo, y así se acredite por la empresa.

Es indiferente, a estos efectos, cuál sea la autoridad que adopte la restricción o la medida de contención. Lo esencial es su competencia para adoptarla, su carácter externo y ajeno a la voluntad del empresario, y su efecto, que debe impedir, en todo o en parte, la continuación de la prestación laboral.

Así, a título de ejemplo, el supuesto más habitual será aquel en que la medida la adopta la autoridad competente respecto a las empresas incluidas en su ámbito geográfico de competencias, como es el caso de los posibles cierres de establecimientos o la limitación de horarios.

Pero, además, resulta evidente que existen medidas que, aun siendo aprobadas por autoridades externas al ámbito geográfico de un centro de trabajo, podrán tener consecuencias directas respecto a la actividad de este. Así, cabe incluir aquellas medidas adoptadas por otros países relativas a restricciones respecto a los lugares de viaje. En casos tales como aquellos en los que las autoridades de terceros países impongan medidas de cuarentena u otras restricciones a los viajeros que proceden de España, puede haber una importante incidencia en la actividad de una empresa, especialmente en los sectores de la hostelería, transporte o industrias conexas.

Por lo demás, admitiendo que las medidas de contención, independientemente de su naturaleza, puedan ser alegadas por la empresa para justificar la reducción de su actividad, no puede dejar de recordarse que la fuerza mayor, como causa motivadora del expediente de regulación temporal de empleo, deberá quedar acreditada debidamente.

Y, además, será necesario acreditar la relación de causalidad entre las restricciones y medidas de contención que se adopten y sus consecuencias en el empleo, así como la valoración de la proporcionalidad de la medida, ya que, como se ha señalado en ocasiones previas, no puede olvidarse que el ERTE por fuerza mayor persigue liberar al empresario de la carga de abonar el salario, cuando la prestación laboral deviene imposible como consecuencia de un hecho externo al círculo de la empresa, imprevisible o, en todo caso, inevitable.

Será preciso que la empresa acredite, de la manera más objetiva y concreta posible, una correlación entre la causa (las restricciones o medidas de contención) y la consecuencia (la imposibilidad de desarrollar la actividad), ya que no toda reducción de la actividad estará íntimamente relacionada con las posibles medidas que se adopten para frenar la pandemia. En ello incide la disposición adicional primera.2 (“Las empresas y entidades que… vean impedido el desarrollo de su actividad por la adopción de nuevas restricciones o medidas de contención que así lo impongan en alguno de sus centros de trabajo”), reforzado por la exposición de motivos, cuando indica que “las empresas y

entidades que soliciten un expediente de regulación temporal de empleo ante la imposibilidad de desarrollar su actividad con motivo de la adopción de nuevas restricciones o medidas de contención como consecuencia de un eventual agravamiento de la pandemia provocada por la COVID-19”.

Por tanto, en los casos en que no se acredite esta correlación, y habiendo reducción de la actividad de la empresa, nos podríamos encontrar ante un ERTE por otras causas, pero no por causa de fuerza mayor, cuestión ya prevista por el artículo 33.4 del Reglamento de los procedimientos de despido colectivo y de suspensión de contratos y reducción de jornada, cuando prevé que “En el supuesto de que, instruido el procedimiento, no se haya constatado la existencia de la fuerza mayor alegada, se podrá iniciar el oportuno procedimiento de despido colectivo o de suspensión de contratos o reducción de jornada, de acuerdo con lo establecido en el Título I.”

5) ÁMBITO DE LOS ERTE DE LA DISPOSICIÓN ADICIONAL PRIMERA.2

Una de las diferencias más sustantivas entre los expedientes previstos en la Disposición adicional primera.2 del Real Decreto ley 24/2020, y los expedientes basados en el artículo 22 del Real Decreto ley 8/2020, es que los primeros definen claramente el centro de trabajo, y no la empresa, como su ámbito de aplicación.

En este sentido, será suficiente que la empresa acredite que se cumplen los dos requisitos exigibles conforme a la Disposición adicional primera.2 (nuevas medidas de contención o restricciones e imposibilidad de desarrollo de la actividad) y la relación de causalidad entre ambos, en alguno de sus centros de trabajo y no en todos, pudiendo concederse la medida solicitada en cuanto a los primeros.

6) CONCURRENCIA DE EXPEDIENTES PREVIOS

El apartado 4 de la Disposición adicional primera del Real Decreto ley 24/2020 establece:

Cuando las empresas y entidades a las que se refieren los apartados anteriores reinicien su actividad, les serán de aplicación desde dicho momento, y hasta el 30 de septiembre de 2020, las medidas reguladas en el artículo 4.1 del presente real decreto-ley.

Las implicaciones de este apartado son las siguientes:

– Estos ERTE son compatibles con los expedientes basados en las causas de los artículos 22 y 23 del Real Decreto-ley 8/2020, tanto los de fuerza mayor total como los de fuerza mayor parcial, preexistentes.

– Estos ERTE también son compatibles con cualquier otro expediente de regulación temporal de empleo preexistente que no esté relacionado con el COVID-19 y con la regulación específica aprobada desde la declaración del Estado de Alarma.

En consecuencia, no es un requisito la renuncia a expedientes de regulación temporal de empleo previos que pueda estar aplicando la empresa en el momento en que se actualice la causa del ERTE previsto por la Disposición adicional primera.2 para que se le pueda autorizar este último.

4 de septiembre de 2020

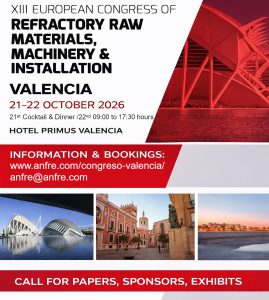

The 63rd international Colloquium on Refractories (ICR®) 2020 will take place 16–17 September 2020 in a virtual setting for researchers and industry experts.

The 63rd international Colloquium on Refractories (ICR®) 2020 will take place 16–17 September 2020 in a virtual setting for researchers and industry experts.