One of the largest markets for industrial minerals, refractories are essential for producing steel, glass, ceramics, cement and lime and for many other processes requiring high temperatures. But as Richard Flook* explains, despite their crucial role, manufacturers of these products are facing significant challenges from changing global trends.

The refractories industry is estimated to currently consume about 40m tpa of industrial minerals and has more than doubled in size in the decade between 2000 and 2010, mainly due to rapid industrialisation in China.

Major markets for refractories are the production of steel, cement and glass and the processing of minerals. The steel, cement and lime industries are estimated to account for about 85% of the total refractory market.

Construction markets therefore drive about 50% of overall refractory demand and automotive and other transport markets account for another 15%.

In 2016, The World Economic Form envisaged the next industrial revolution and the «emergence of technologies that have the power to drive a whole new cycle of global economic activity». More recently, the Organisation for Economic Co-operation and Development (OECD) talked about the next production revolution, which «will occur because of a confluence of technologies» and will involve new materials and new processes and will transform production.

Emerging technologies include smart factories and automation, robotics, 3D printing and contour crafting and driverless and electric vehicles (EVs).

Electric growth

Environmental concerns and advances in technology are driving a shift in the global energy mix. In its Energy Outlook 2017, major oil producer BP forecast that thermal coal consumption will peak in the 2020s. Oil and gas, together with coal, are expected to remain the main sources of energy, accounting for more than 75% of total energy supply, in 2035, but this will be down significantly from their 86% market share in 2015.

Meanwhile, renewables are projected to be the fastest-growing fuel sources over the same period, expanding at a compound annual growth rate (CAGR) of 7.6%.

Data collected by Bloomberg suggest that solar and wind will dominate new electricity installations and account for nearly 50% of installed capacity by 2040. Many large corporations are actively promoting decarbonisation and renewable energy targets.

For example, Dutch paints company AkzoNobel NV is attempting to be carbon neutral and use 100% renewable energy by 2050, while US brewing firm Anheuser-Busch is aiming to purchase 100% of its electricity from renewable sources by 2025.

BP estimate that electric car sales will increase from 1.2m in 2015 to around 100m in 2035 (around 5% of the global car fleet), representing a CAGR of 25%. India is aiming for sales of all new vehicles to be electric after 2030, France has announced that petrol and diesel new car sales will be banned after 2040 and the UK has said that all new car sales must be for electric models after the same date.

Other forecasters expect that by 2030, the cost to store energy in batteries will reach parity with the internal combustion engine, which will deliver a huge boost to EV sales.

Implications for refractories

Implications for refractories

The growth of large scale renewable energy projects will require significant quantities of durable, corrosion-resistant coated steel. However, growth in the market for steel in automobiles is expected to slow, due to the requirement for lighter and stronger components. Advanced high-strength steel alloys are also expected to face increasing competition from plastic composites and lightweight metals, such as aluminium.

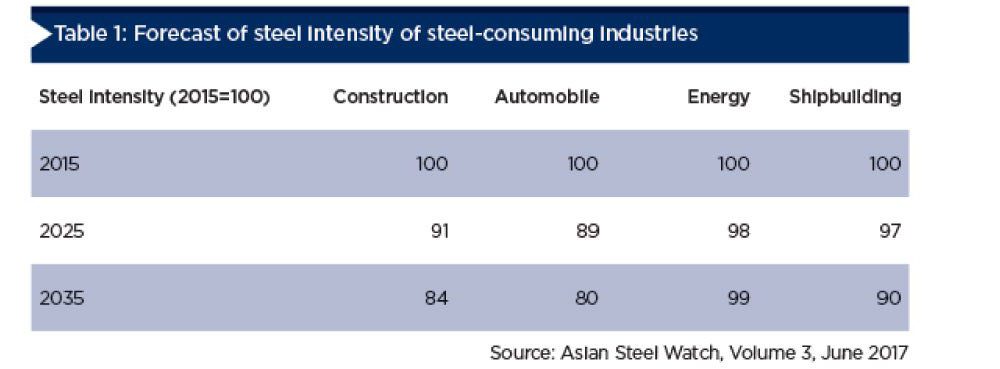

South Korean steelmaker POSCO has estimated that the steel intensity of a many steel-consuming industries will substantially decrease in the next 20 years (see Table 1). In particular, the company estimates that the steel intensity of the automobile industry will decline by 20%, while that of the construction industry will decline by about 16%.

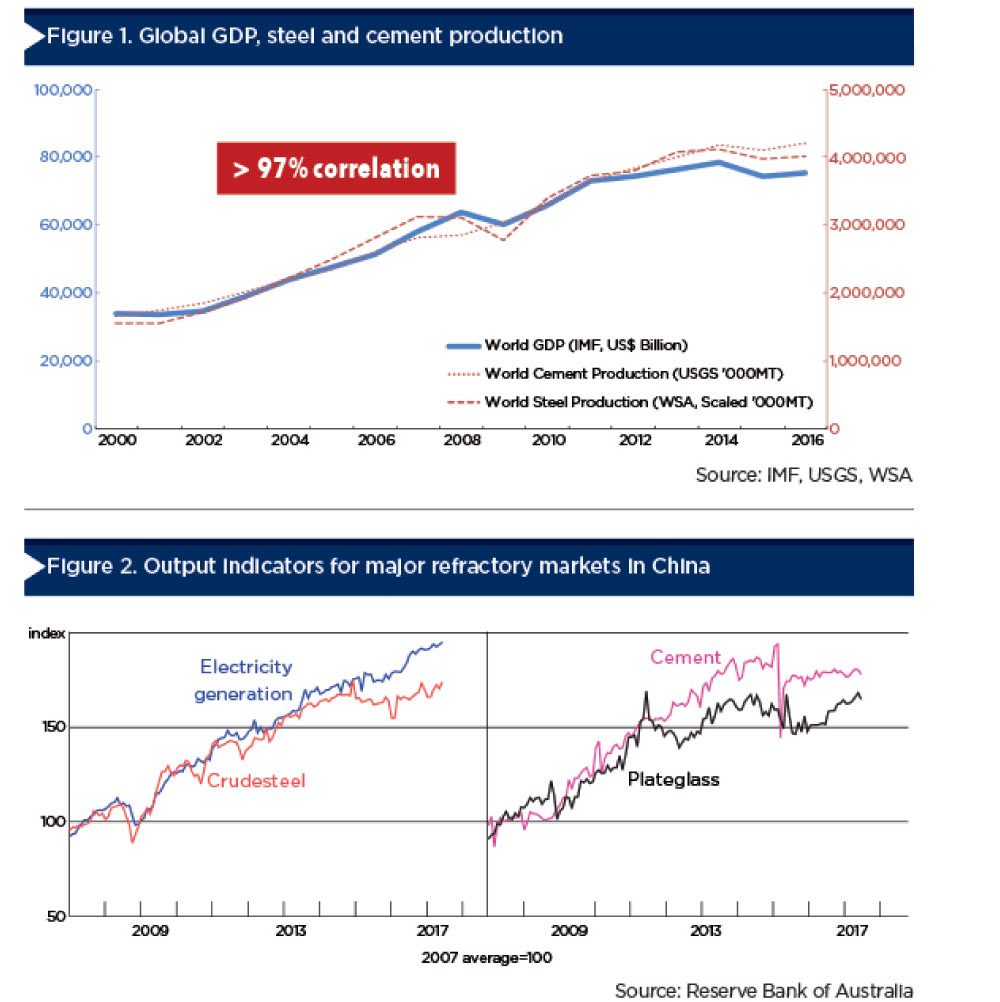

In the long run, global GDP is a good indicator for both steel and cement demand, with a 97% correlation between 2000 and 2016 (see Figure 1).

Global economic growth has slowed in the last decade and macro political risks are increasing. In the absence of global shocks, global GDP is expected to be 2-4% on a purchasing power parity (PPP) measure in the short term, with higher growth in Asia.

China, India and the Association of Southeast Asian Nations (ASEAN) are expected to remain relatively high growth regions with GDP expansion of 5-7% and are expected to account for 60% of global growth. By 2050, Indonesia is expected to join China and India as one of the world’s largest economies, with Vietnam and the Philippines making the greatest gains in global ranking.

In the short term, China remains the major global economic driver, although the recent downgrade of China’s sovereign credit rating on debt concerns has raised questions over its future growth prospects. At China’s 12th National People’s Congress in March 2017, the GDP growth target for 2017 was set at 6.5%.

Reducing pollution and moving industry from low-value to high-value manufacturing have become short-to-medium term priorities. These trends have already adversely impacted demand for refractories, as well as the supply of certain refractory raw materials in China.

Production of steel, cement and flat glass in China, the dominant global producer of these materials, has been relatively stagnant for a few years (see Figure 2).

Refractory raw materials and China

China provides the majority of the raw materials used for its own refractory production and for about a quarter of the raw materials needed for refractory production outside China. In particular China is a global leader in the supply of refractory bauxite, brown fused alumina (BFA), fused magnesia (FM) and dead burned magnesia (DBM).

It is no wonder that recent events in China are causing some concern with refractory producers relying on raw materials from China.

China is estimated to produce about 69% of the world’s magnesite and 63% of the world’s magnesia and supply 44% of the world’s magnesia exports.

Earlier in 2017 pollution inspection teams were said to have effected output in about 95% of magnesia producers in Liaoning province. Production was reduced and prices increased.

Combined production of Chinese DBM and FM was down about 55% y-o-y in June 2017 and nearly 30% for the first half of 2017. Refractory production in China was also down about 15% in the first six months of 2017. In the same period, prices of FM and DBM rose at a rate of around 90%, according to the IM Pricing Database. For both DBM and FM the highest increases were for higher purity products.

More recently, it has been reported that consolidation of the magnesia industry is planned in Liaoning with almost 80% of national production to be controlled by China Magnesite Mining Co. which will be 51% owned by Haicheng Magnesite Factory.

In Shanxi province similar environmental inspections and restrictions have affected the supply and prices of refractory grade bauxite and fused alumina. Prices of calcined bauxite have increased by about 25% in 2017 according to IM Pricing Database. Graphite electrodes which are used in fused mineral production are also in tight supply and have experienced large price increases of over 300% which is adversely affecting Chinese and global fused mineral production.

In a separate development it has been reported that 73 Chinese titanium dioxide (TiO2) feedstock plants are being permanently closed by the government due to failure to meet anti pollution requirements.

There is no expectation that the supply of Chinese raw materials will improve at least in the short term. There are now strong indications that the long term outlook is no better. China has been the world’s biggest commodity manufacturer since 2010 but the «Made in China 2015» programme calls for China to be more self-sufficient in advanced manufacturing and the dominant global producer by 2049. If successful, this will reduce the economic requirement for Chinese production of commodity products such as steel and cement and will reduce the domestic demand for refractory raw materials. Combined with stricter environmental controls, it is not hard to see continuing increases in the costs of Chinese refractory raw materials.

It would appear that export of industrial minerals from China will be more difficult in the future and the age of cheap Chinese raw materials is or will be now over. Development of non-Chinese industrial mineral raw materials will become more important and a necessary strategy for non-Chinese customers of refractory and industrial minerals.

Steel outlook

The World Steel Association (worldsteel) is predicting 1.3% growth in global steel production in 2017 and 0.9% in 2018. Growth outside China is expected to be higher, at 2.4% in 2017 and 3.1% in 2018.

However, these projections are currently looking too modest. In the first six months of 2017, world crude steel production was 836m tonnes, an increase of 4.5% compared to the same period in 2016. Global steel production would have to be 3.1% lower in the second half of 2017 compared to the same period in 2016 to match worldsteel’s projection of a 1.3% increase this year.

POSCO has made longer-term projections of global steel, demand based on four main considerations: slowing consumption growth, in line with decreasing steel intensity (see Table 1); a need for more advanced steel products; steelmakers upgrading to eco-friendly and smart steel making processes; and moves to create value using the Internet of Things (IoT), big data and artificial intelligence.

Taking account of these trends, POSCO forecasts that global steel demand will grow at a CAGR of 1.2% between 2016 and 2025 and at a CAGR of 0.9% between 2025 and 2035.

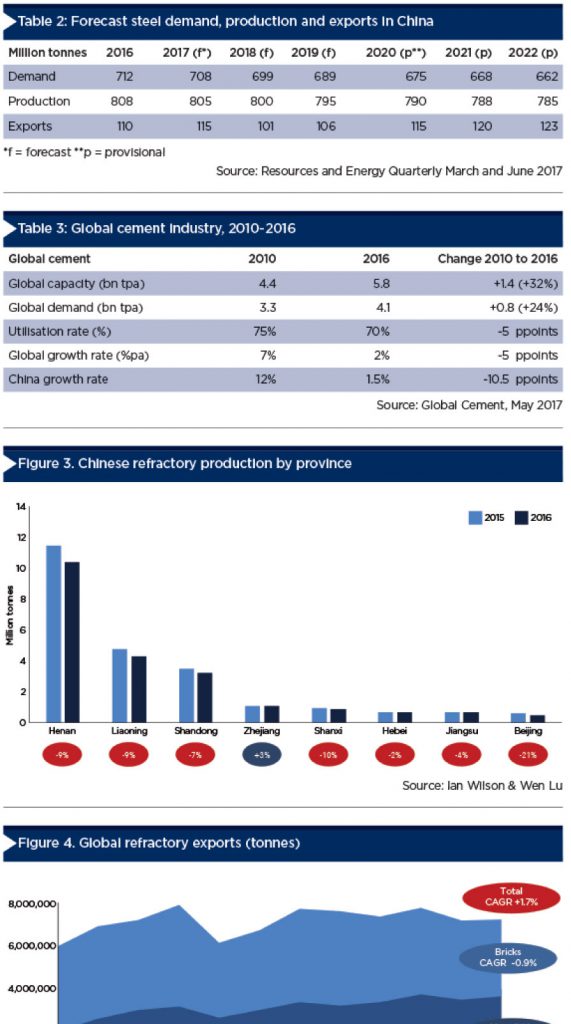

These projections are broadly in agreement with the latest estimates from the Australian Chief Economist, which point to global steel production and demand growth of about 1.1% between 2016 and 2019 (see Table 2).

The Australian government expects steel production in China to fall and settle below 800m tpa, while demand is forecast to remain below 700m tpa and progressively decline. The growing number of trade restrictions, including tighter US protectionist measures, may further restrict Chinese steel exports and production.

Industry bodies the China Iron and Steel Association and the China Metallurgical Industry Planning and Research Institute are forecasting even greater declines in steel demand to below 600m tpa by 2020 and to about 490m tpa by 2030.

In stark contrast, some iron ore producers have predicted that steel production in China will in fact increase and peak at about 950m tpa in the mid 2020s.

Cement outlook

Compared to steel, the outlook for global cement production is more positive. Even though growth slowed and overcapacity increased between 2010 and 2016 (see Table 3), most large cement producers are forecasting a CAGR of 2-4% between 2017 and 2019. High growth areas include sub-Saharan Africa, India, Indonesia, the Philippines and parts of the US.

The major issue facing the Western cement and lime industry is decarbonisation. According to the European Cement Association, for the industry to reach the European Commission’s target of 80% carbon dioxide (CO2) reduction in cement production by 2050, «breakthrough technology» will be required.

The refractories industry is estimated to currently consume about 40 million tonnes pa of industrial minerals and has more than doubled in size in the decade between 2000 and 2010 mainly due to the rapid industrialisation in China.

Refractories production and trade

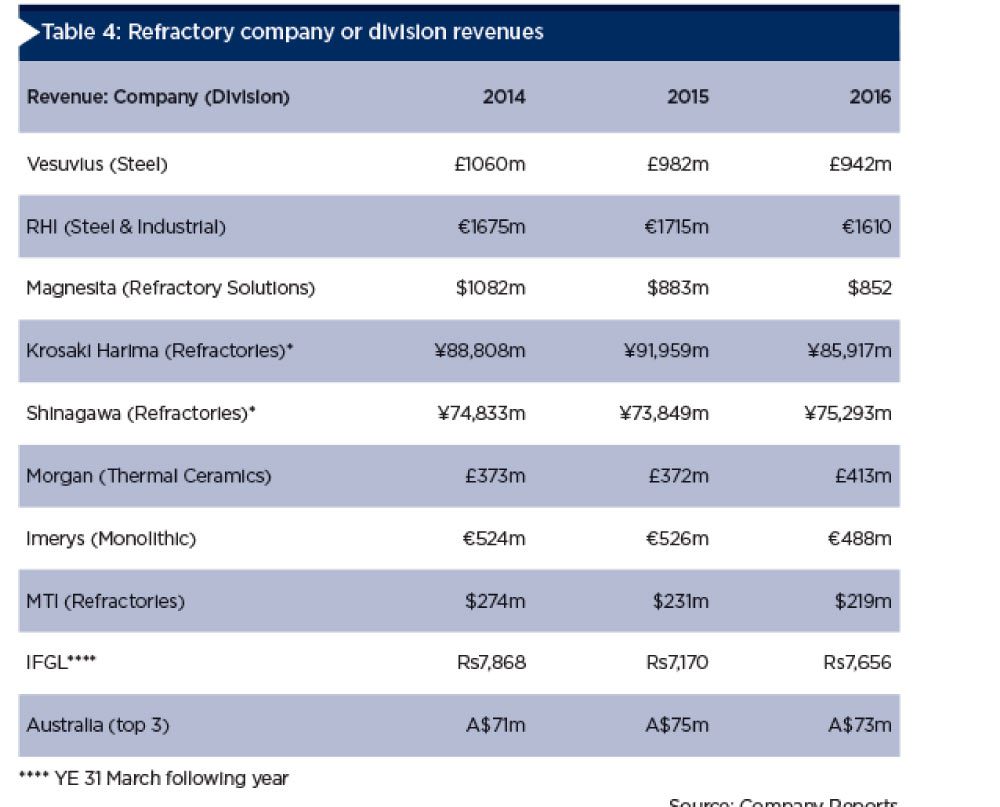

Sales revenues of some of the major global refractory companies, together with the refractory divisions of other broader manufacturing business, have been stagnant or declining in recent years (see Table 4).

In US dollar terms, overall revenue decline in 2016 was about 4.5%.

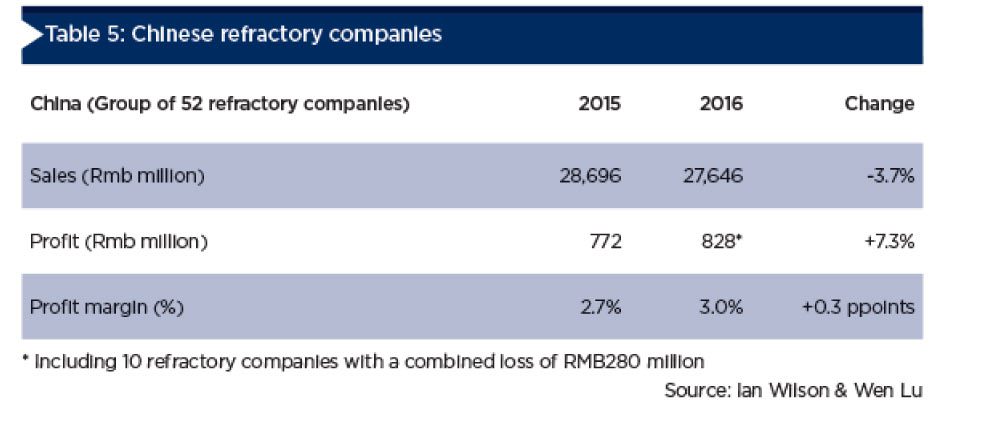

The 52 major Chinese refractory companies recorded a 3.7% decline in revenue in 2016 (see Table 5). Profit margins improved slightly, but were still only around 3% on average. Total Chinese refractory production dropped almost 9% to 23.9m tonnes last year and apparent domestic consumption shrank by a similar amount to 21.9m tonnes in 2016.

Refractory brick production and consumption both fell by about 13%, which was more than double the decline of 5-6% in monolithic refractory production and consumption. The decline was recorded across almost every province (see Figure 3).

Both production and consumption of refractories in China in 2016 were down by about 27% from the peak in 2006.

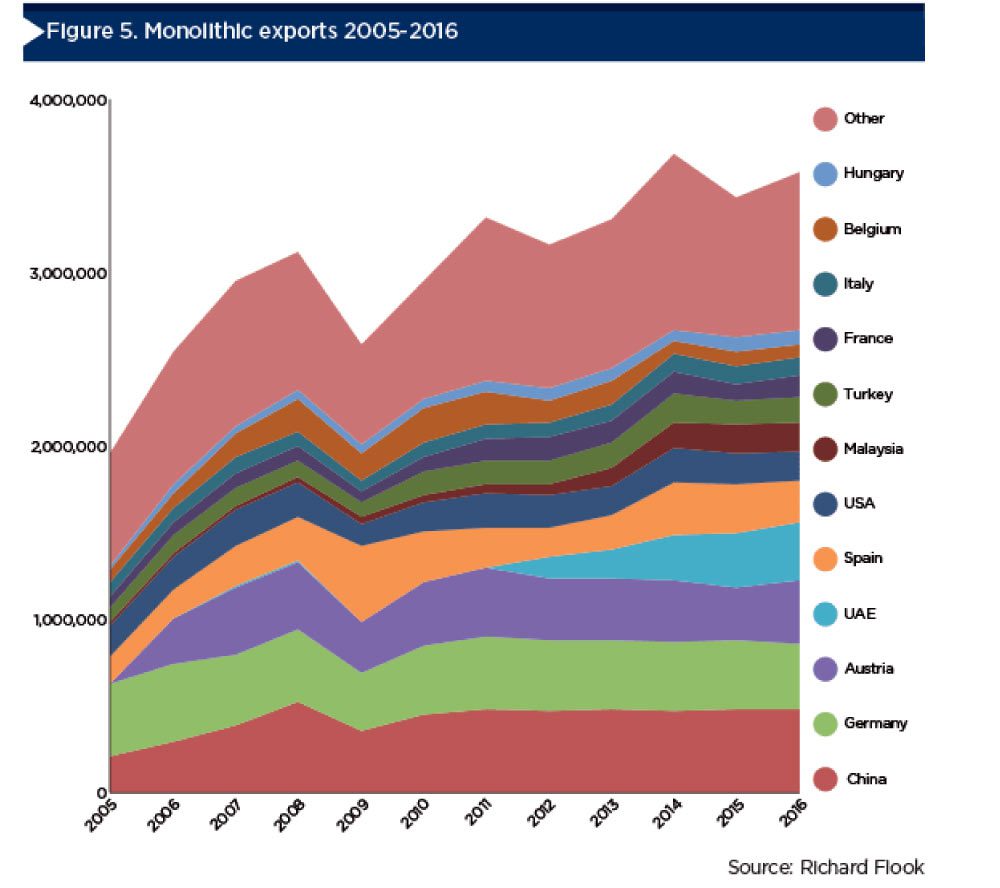

Global refractory trade has grown at a CAGR of 1.7% between 2005 and 2016 (see Figure 4). However, refractory brick trade has been declining at a CAGR of about -0.9%, while monolithic trade has been growing relatively strongly at a CAGR 5.7%. Consequently, monolithic trade has risen from about one third of total trade in 2005 to about half in 2016.

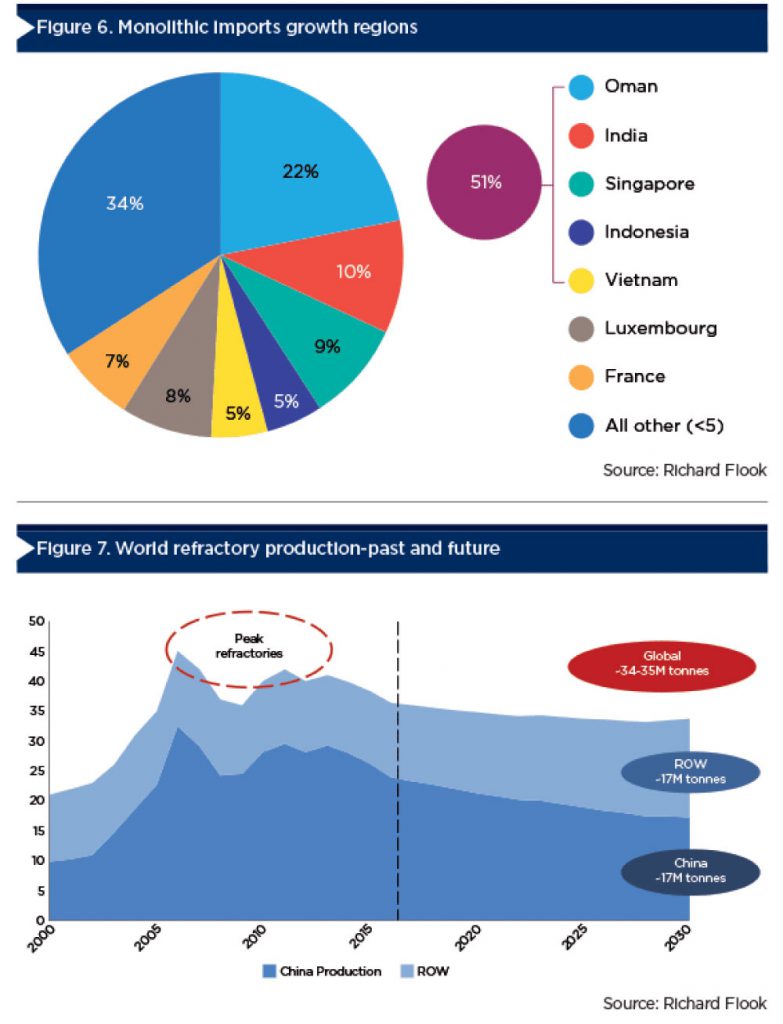

The top 10 exporters of monolithics account for about 60% of total monolithic trade, with most growth in exports coming from Austria, UAE, China and Malaysia. Significant growth has mainly been in Oman, India, and the ASEAN countries of Singapore, Indonesia and Vietnam. (see Figures 5 and 6).

Refractory outlook

Refractory consumers are facing a range of issues, including but not limited to, weak market growth, decarbonisation, reduced application intensity, alternative fuels, competition from substitutes, pollution restrictions, overcapacity and low profitability.

The modest growth outlook for the major refractory markets in the next decade point to subdued expansion in demand for refractories. In this low growth environment, a further round of mergers

and takeovers is likely to occur in the refractory industry, including perhaps Chinese refractory companies expanding further into global markets.

The rapid growth in, and persistently high level of, global refractory production between 2000 and 2010 was to a large degree caused by inefficiencies in Chinese steel production, combined with readily available domestic supplies of refractory raw materials.

Specific refractory consumption of about 40kg/tonne of steel in 2000 has progressively declined to an estimated 15kg/tonne in 2016. Specific consumption in China is expected to decline even further to reach the rest of the world’s average standard of about 10kg/tonne in the next decade, due to improved steel production efficiencies together with the increasing use of recycled steel.

The combination of the above factors is expected to result in the global refractory market remaining at about 34-35m tpa for a number of years as the drop in production in China is balanced by steady growth in the rest of the world (see Figure7).

*Richard Flook is the Managing Principal at Mosman Resources. He has worked for both suppliers and consumers of minerals with global companies including, Steetley plc, Anglo American, Commercial Minerals (now Sibelco), Normandy Mining Ltd, Omya AG and Shinagawa Refractories. Richard is a Fellow of the Australasian Institute of Mining & Metallurgy (FAusIMM (CP)), the Australian Institute of Company Directors (FAICD) and the Australian Institute of Energy (FAIE). He is a graduate of Sydney University (BSc First Class Honours, PhD) and the University of NSW (Master of Commerce). Since 2014, Richard’s has been the Managing Principal of Mosman Resources, a private consulting business, specialising in the production and marketing of industrial minerals and chemicals.

Refractories for Glass Production

P.Carlo Ratto*

Global annual glass production is estimated to be about 210m tonnes. Refractory demand for glass production is estimated to be around 500,000 tpa or about 2.4 Kg of refractory per tonne of glass.

Fused-cast refractories are a major category of refractory used in glass production (100,000 tpa). The second major group is basic refractory for regenerator packages which is almost the same or perhaps slightly more (about 120,000 tpa). Other refractory types are silica wedges for crown (about 80,000 tpa), generic silico-alumina, alumina, zircon and insulating firebrick (IFB) for all other applications (about 200,000 tpa in total).

SEPR Saint-Gobain is by far the major fused-cast refractory producer, with a total of seven plants worldwide. They represent about 55% of western, or about 43% of total world production. Alumina-zirconia-silica (AZS) fused cast refractories are still the major product group followed by aluminas and specialties. Globally speaking the major raw material is calcined alumina (about 63%) together with zircon sand (about 28%), synthetic zirconia (about 6%) and sodium carbonate (about 3%).

On a global basis flat glass production is slowly growing (about 2% pa), container glass production is flat and fibre glass is slowly growing. Low volume display glasses for computers and smartphones are growing at much higher rates but volumes are small and therefore related refractory usage is also small.

In general, glassmakers are facing similar issues to those for other refractory customers such as production overcapacity, energy consumption, pollution and decarbonisation.