Apr. 02, 2019 – In March, on the one hand, shortage of supply continues for several refractory raw materials; on the other hand, price decline keeps going forward for some types of minerals.

Calcined bauxite met no significant improvements both in price and in supply, but biding proceedings started for bauxite ore mine in Xiaoyi.

Brown fused alumina and white fused alumina saw slow growth of capacity usage, while supply improvement still needs time

Magnesia kept slight downwards in price due to the weak demand status, however, dynamite was not released again even in limited scale, coupled with a new round of environmental protection inspection, foreboding the new uncertainty;

Flake graphite started production season in Northeast China, with not market price fluctuation until now;

industrial alumina continues dropping down in price, but failed to pull down offers of alumina-based refractory raw materials;

Silicon carbide still keeps soaring price by production restriction.

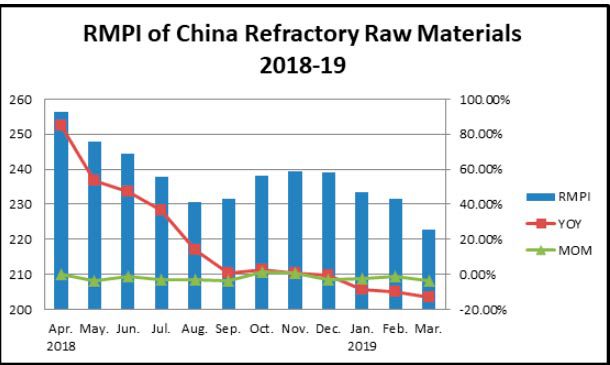

RMPI (Refractory Raw Materials Price Index) dropped down to 222.65, down 13.05% year on year and down 3.67% compared with the previous month, which is mainly bring down by magnesia.

Xiaoyi county – March comes in the calm for most of refractory minerals in China, including bauxite market. Production situation shows the same as the previous two months in Xiaoyi district (one of main calcined bauxite producing areas in China), with most of calcination kilns in stoppage, about 20 licensed plants in work, and one mine company in production for bauxite raw.

According to those plants with rotary kilns in work, supply is gradually getting recovered and even some plants have got some stockpile resulted from the demand depression after Chinese Lunar New Year. However, the overall supply still remains shortage in Xiaoyi district. As those calcination plants referred above restart the production, shortage of raw bauxite supply stands in the first breach of the market since only one mining site is available to supply.

It’s reported that some participants are building or planing to build shaft kilns to fill up the capacity gaps that resulted from the shutdown of downdraft kiln in Xiaoyi County. Local calcined bauxite market is predicted to keep tense supply in coming month as the demand recovers both from China and overseas market.

Yangquan county – In March, the biggest challenge that the calcined bauxite market faces is still the absence of supply capacity, and followed by the quality trouble, with no significant changes of market price in Yangquan, Shanxi province in February and early March.

Production situation doesn’t turn better, neither turn worse in March, but environmental protection keeps going forward in Yangquan. Capacity usage situation is unexpected to significantly improve in March and cost of natural gas is unlikely to drop down before the end of this month. All these factors above have slowed down the production recovery in this region. Moreover, bauxite ore supply is still a key problem that confuses the industry. For most of producers, high cost of good quality bauxite ore has become beyond their cost controlling capacity and secondary grade of bauxite ore also reaches a higher price that beyond their usage value.

Henan province – Supply situation of calcined bauxite keeps squeezing over the past 3 months in Henan province because of the serious implementation of environmental protection action. There is no sign that it will turn to be better until now with the end of heating season.

Due to the fact that serious air pollution hovers and continues, production suspension and stoppage is unlikely to remove by the end of March. As the Refwin market monitoring, most kilns in Luoyang and Gongyi (the county in Zhengzhou with a large amount of calcination plants) are in the situation of stoppage or capacity restriction. Some local producers said they have kept in production stoppage since the early of the last December.

Ultra-low emission standards are being pushed by governments among all the cities in this province, which foresees the possibility leads into another round of environmental protection upgrading actions in this year, according to some local participants.

Guizhou province – Market prices of calcined bauxite for different grades in Guizhou province have been turned out to catch up those in the north China after several months of environmental protection actions.

According to Refwin date sources, market price of bauxite ore had increased by RMB 50/t in Guizhou province by the end of February compared with the earlier month in this winter. However, there is no significant changes in this month against the seasonal depression.

The overall capacity usage of calcination plants has kept at the very low level over the past few months. The progress of kiln upgrading shows different situations to local participants, in which some meet difficulties in capacity replacement and others fail to push forward the construction for new kilns by the failure to obtain licence. However, some capacity is recovering or foresees recovery in short future, which seems to be the only good news for Chinese calcined bauxite industry over the past 3 months

The market price is predicted to keep at the high level in short period in future although signs of capacity improvement are forming.

In summary, overall supply situation in China shows no significant changes by the end of March, although some plants are reported to be in slow recovery, the shortage of bauxite ore still restricts the supply. News has been officially released that one of the mine sites owned by CHALCO in Xiaoyi has started for bidding. Successful bidder will have the right for mining in coming 1.5 years, and also the responsibility for the ecological restoration, emission control, sewage treatment, etc. Future is full of uncertainties, mixed with hope.

Magnesia

FM – In March, ex-works prices of fused magnesia in Liaoning keep falling as a result of market downturn, for that of 95.5%, 96%, 96.5% and 97%.

Since there is nearly no improvement in market demand, magnesia trade tends to be rather thin, leading to mounting inventory pressure on magnesia producers, from as little as a few hundred tons to as much as tens of thousands of tons.

Magnesia producers lower prices to boost sales and to ease inventory pressure, but there is little space for further price cut, supported by labor, power and other production costs.

What’s more, a new round of looking back actions on environmental protection is said to be conducted in Liaoning starting from early April, chiefly in Haicheng, where some local magnesia producers is likely to suspend production, which may inhibite the yield to some extent, causing stabilized prices.

However, a genuine upturn in the market will require a benign long-term balance between supply and demand. DBM – In Mar.

DBM magnesia producers successively put price down under depressed market. Now mainstream ex-works price including tax of dead burned magnesia 92%, lump is RMB 1,550-1,700/t. That of dead burned magnesia 90%, lump is RMB 1,400-1,600/t. Some big orders can gain certain benefit.

There are two factors causing price down. On the one hand, grade of magnesite mines is declining, making it hard to back up DBM price. On the other hand, downstream demand is inactive, causing sluggish delivery of goods and great inventory pressure. Ultimately, producers have to lower the price. Refwin predicts the flat market condition will last in short run.

In summary, both DBM and FM keep in the downturn in price and demand in China currently compared with that at the beginning of environmental regulation, but environmental protection inspection by central government which is said to have already started and will soon cover Liaoning province again, making the future running of magnesia market stand at a position in variable.

Silicon Carbide

In early March, silicon carbide prices keep stable at a high level. As local stocks continue to be consumed, it is necessary to observe whether the price will continue to rise.

At present, Gansu silicon carbide enterprises, especially in Kuangou Industrial Park, are still out of production mainly affected by environmental protection and policy factors. And the inventory of each enterprise has been very small.

Since the “two sessions” were held in March, there will be no changes in the policy of the Kuangou Industrial Park. For the future price trend of silicon carbide in Gansu after the end of the “two sessions”, Refwin believes that it depends on the demand of downstream customers.

Brown fused alumina

Henan province – In early March, overall capacity usage of brown fused alumina keeps at a very low level, with no significant changes compared to the previous month in Henan province.

Since 12, February, when local government in Zhengzhou, the capital city of Henan province, announced to enter the status of severe air pollution alarm, overall production stoppage and restriction has come back from a short break during Chinese Spring Festival, which has lasted until now. On March 2nd, a new government action brings a new round of 60 days of production restriction in Sanmenxia District, clarifying the production and capacity restriction will not remove in coming 2 months.

Calcined bauxite continues tight situation in supply side, coupled with capacity restriction, making the market of BFA keep going forward suppliers market, but it’s hard to appear to be further increasing in price, according to some insiders.

Guizhou province – It’s reported that the market price (ex-work price before VAT) for brown fused alumina in fractional size and powder has increased by RMB 100-150/t in Guizhou province, compared with the previous month.

Local calcined bauxite supply has tended to shortage since the second half of 2018 as facility upgrades to meet environmental protection policies, which has led to production stoppage or capacity cutting down. As the production restriction and ore ban keep going forward in Henan and Shanxi province, ex-work price for bauxite ore in Guizhou province has been reported to rise again, up RMB 60/t compared with the previous month, according to local participant.

According to some local participants, some BFA facilities have to stopped partly or entirely because of the shortage of calcined bauxite. If the current situation keeps going forwards, price is expected to grow up further.

In summary, brown fused alumina still keeps at high price by the end of March although the overall capacity utilization in Henan province has gradually improved during this period of time; however, in Guizhou province, situation is still at upward forecast in price. In April, impacts by production restriction foresee a decline while the situation of calcined bauxite supply will play a more vital role.

White fused alumina

Henan province – White fused alumina remains tight supply at low capacity usage level in Henan province at the first half of March.

It is understood that most WFA smelting plants in Zhengzhou and Dengfeng still remain at the production stoppage or, for less companies, production restriction.

Industrial alumina has continued weakening situation recently, which is predicted to rebound in the near future although it has not yet seen signs of that, according to some local insiders. No clear date is confirmed for the removing of production restriction policy, WFA is likely to remain shortage in coming weeks.

Since the mid of March, capacity utilization rate has started to regrow although production stoppage policy still remains.

Shandong province – Capacity usage of white fused alumina is reported to remain at a relatively low status in Shandong province, one of the main production provinces for WFA in China.

During the NPC and CPPCC, local government fastens onto the environmental protection action, which is the main reason that leads to capacity reduction. In Zibo, the main source region of WFA, even processing plants have stopped. As the demand is recovering, shortage of WFA becomes a matter of great urgency.

However, there is no significant price adjustment, benefiting from the industrial alumina, which has kept at very low price in past 2 months.

As for the second half of March, local exporters are reported to lift their FOB quotations, mainly caused by the unstable exchange rate.

In summary, shortage of supply is the basic status in the last month and this is likely to remain to the end of April even on the basis of favorable capacity usage recovery as the global demand is predicted to rise with the beginning of purchasing season.

Flake Graphite

Market prices of high grade flake graphite in Shandong still keep steady in March. While prices of low and medium grade flake graphite may fluctuate in future due to the influence of imported flake graphite.

At present, the production of flake graphite enterprises in Shandong is normal, and the overall market demand has not fluctuated greatly. It is expected that flake graphite will maintain a steady operation in the first half of the year. As the country pays more and more attention to the negative electrode materials, the demand for flake graphite in this industry is growing rapidly.

As a whole, due to environmental factors, the demand for flake graphite in the refractory industry is gradually shrinking.

Industrial alumina

Mar. 29, 2019 – According to Refwin, currently, the price of domestic industrial alumina remains slightly downward trend against, with lowest price hit down at RMB 2700-2800/t, but non-metallurgical alumina for refractories industry offers at a relatively higher level.

It is reported that some of factories producing industrial alumina have cut their capacity due to the overall market downturn, leading to a slight reduction of supply. However, the new capacity for industrial alumina that plans to put in commission in the first half of this year is predicted to be sizable, with an estimate of 6.8 million tons in this year, while the new capacity for electrolytic aluminium boasts 3.1 million tons during the same period. What’s more, about 8 million tons of planing capacity for industrial alumina is on the way for 2020. Therefore, the decreasing production of industrial alumina has little influence on the market in terms of the huge demand. Moreover, the imbalance between supply and demand in the market still goes on with the reduction of electrolytic aluminium capacity

It’s said that about 50 thousand tons of industrial alumina was imported in Feb, down 37.5%, and 3,443 tons for export, down 97.6% compared with the volume of 142,864 tons of the previous month.

Recent news breaks that Norway-based Norsk Hydro A.S. agrees to operate third party technology assessment proposed by a Brazilian prosecutor, which means factories producing industrial alumina can continue to manufacture once the assessment is successful. On 26th, March, the vice president of Norsk Hydro A.S. announced that Alunorte’s aim is to maintain 7 production lines as a way to improve capacity and it is predicted that 75% or 80% is available after the two-month assessment. If it makes it, international supply of industrial alumina will increase significantly and the price is more competitive compared with that of domestic industrial alumina. Consequently, the export of industrial alumina at home faces a huge hinderance.

In a word, the domestic market price approaches to costs but it’s hard to say how long it will last at the bottom level.